Britain’s “Brexit” dust settles, what the dropshipper should do for UK shipping?

At around 4 p.m. Brussels time on December 24, European Commission President von der Leyen and EU Chief Negotiator Barnier held a press conference to announce a formal “Brexit” trade agreement with the UK, which defines the relationship between the UK and Europe after the end of the “Brexit” transition period on January 1 next year.

After more than nine months of tug-of-war negotiations, the EU and the UK negotiations finally “broke”! Later, British Prime Minister Johnson also tweeted: “(EU-UK trade) agreement reached.”

The impact of the UK’s “Brexit” on dropshipper

According to the announcement issued by the European Commission, the core of the agreement is a “Europe-UK Free Trade Agreement”, covering all aspects of Europe-UK trade in goods and services, investment, competition, prohibition of state aid, taxation, transport, energy, fisheries and even data protection, social security coordination, etc.

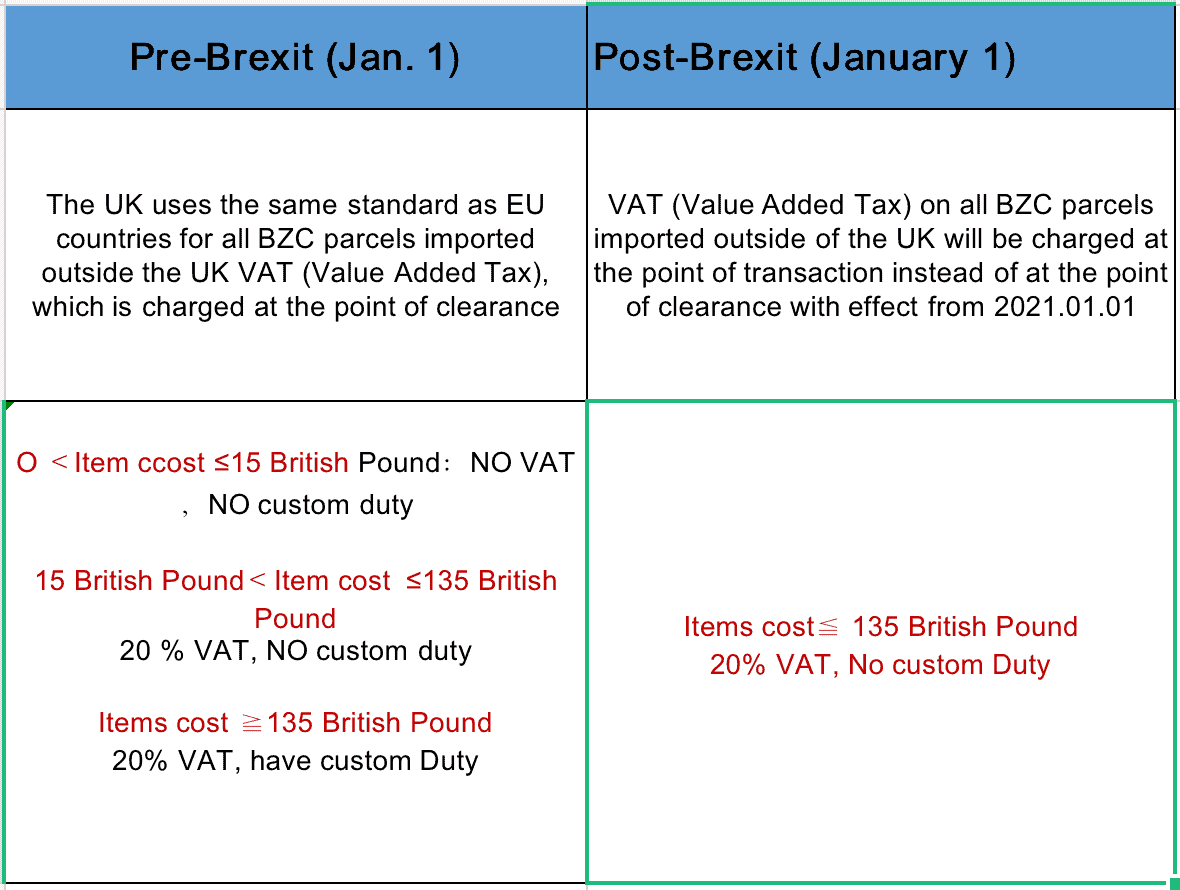

Among them, the impact of Britain’s “Brexit” on cross-border e-commerce sellers, especially direct mail sellers, Dropshipme brings you a heavy interpretation of.

- After January 1, 2021, Cloudway Logistics will no longer collect VAT in advance, sellers can be paid by the platform or declare to HMRC on their own.

- Non-platform sellers can choose to provide VAT and EORI tax numbers when placing orders, and shipments can be made whether they are provided or not. If the seller does not provide VAT / EORI, the seller will be responsible for any abnormal customs clearance (for UK VAT / EORI registration guidelines, please contact Cloudway account manager for more information);

- Cloudway Logistics has added VAT / EORI tax code field and pound declaration function, please contact ERp service provider in advance to confirm the setting method.

- The UK Customs has the right to review the price of the cleared goods, it is recommended that sellers declare truthfully according to the transaction price to reduce the risk of inspection.

- For parcels over £1,35, yunexpress Logistics will consider opening the service at a later date to be determined.

- Please understand that Brexit and tax reform policies may lead to a decrease in the speed of customs clearance, thus causing the impact on the timeframe!

All in all, cross-border e-commerce industry compliance is the general trend, register VAT account in advance to be prepared. For e-commerce sellers, the most important thing at this stage is to embrace the market changes, properly handle the transition period after Brexit, increase the core competitiveness of products and choose the right logistics service provider.

Dropshipme will also make further understanding of the new UK VAT tax reform, and the latest news will be released in the public number at the first time.